I am late to the party. My daughters will turn 4 and 2 years old in a few weeks — and I currently only have $1,000 in one 529 savings plan account. I speak with other parents at work, or friends — and within my circle, people suggest that we should have a 529 savings plan account.

I feel lucky that I can even think about putting money into a long term college savings account.

I’ve done the math, and with college tuition going up 5-8% per year … the least I can do for my two girls is put some money aside for what I hope is their college education.

What is a 529 savings plan account?

Per wikipedia, a 529 savings account is a tax-advantaged investment vehicle in the United States designed to encourage saving for the future higher education expenses of a designated beneficiary.

In English – it’s an investing account where your investment grows tax free if the money is spent in education for your kid (or you … more on that later).

The recommendation is that you should not invest in a savings 529 plan unless you have maxed your 401k and/or IRAs. This is kind of like what they say on the flight before take-off. Make sure to put the mask on yourself first before you help your kids. And I agree.

With seven in 10 seniors (68%) graduating from colleges in 2015 having student loan debt, my wife and I have decided that it’s time we start being selfless and think of our girls future. While I think students should work hard to build a life, if we’re lucky enough to save for retirement, and have some extra to save for their college, why not?

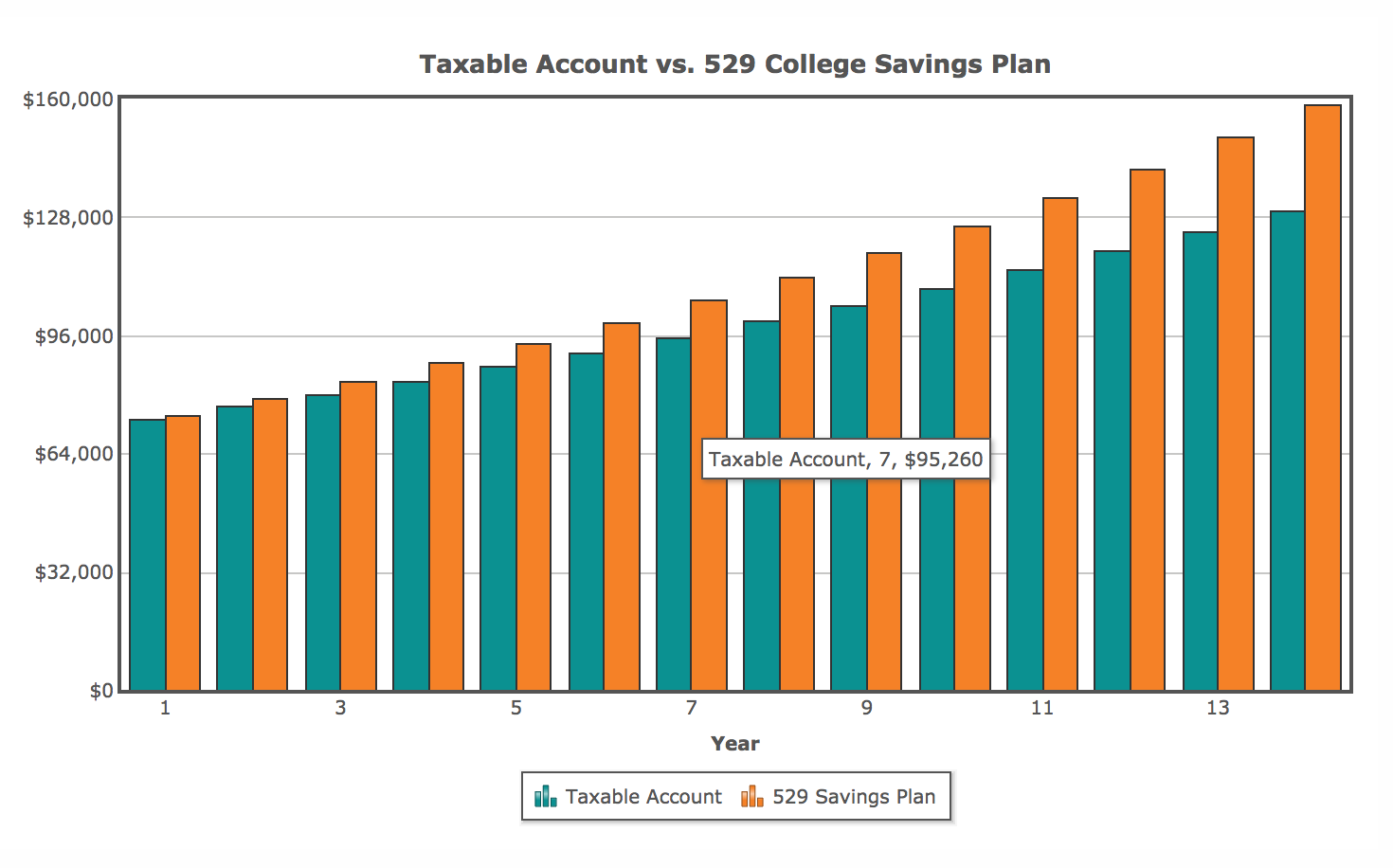

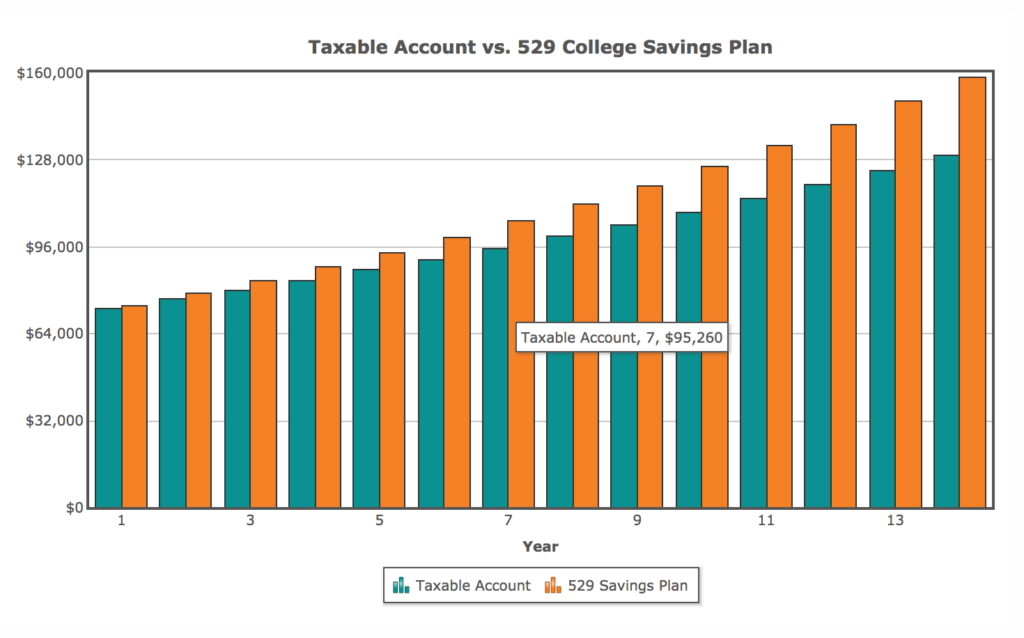

The first question I had was – why not use a regular account vs 529? To find that out, I used a 529 plan calculator and saw the huge advantage a tax-sheltered account had:

529 what?! .. so much confusion

At first, looking into 529 plans seems confusing: multiple states, multiple investment options, no limits but gift tax … etc etc. I’ll try to break it down for you.

- Every state has a 529 plan and SOME states provide state tax deductions

- There is a limit of around $400,000 or so per account

- Don’t worry about gift tax unless you plan to gift more than $5M as gifts in your life time

- You can buy any state’s 529 savings plan

- There is no amount limit per year that you can contribute (except for the fact that you’ll reduce your life-time gift tax limit if more than $14,000)

- BUT you can contribute a lump-sum of up to $70,000 without activating the gift tax as long as you don’t deposit into the account for another 5 years

We live in CA and there is no extra benefit to get our state’s savings plan. Therefore I want to find a savings plan that has low cost and ample investment options.

A great comparison tool is vanguard’s. It helps you narrow down to your state and compare investment options, expense, minimum contribution, etc.

The main two plans we debated about were Nevada and Utah. Both of them offer Vanguard’s low cost index funds, and both of them have low fees.

Investment options

Vanguard and Utah both offer ample investment options: age based and static funds.

Fees

Vanguard (see here)

Asset management: There’s a $20 annual maintenance fee on balances below $3,000, other than that, nothing, zero, nada.

Expense ratios: They range from 0.17-0.45% depending on the fund(s) you invest in.

Utah 529 (see here)

Asset management: There is a 0.2% asset management fee for all accounts. There is a $12/year mail fee (but you can waive it if you do online statements).

Expense ratios: They range from 0.00-0.60% depending on the fund(s) you invest in.

So which 529 plan did we chose?

As you can see above, if you chose the cheapest investment fund in each account, the difference is 0.03%, that’s $30/year or $540 in 18 years.

We’re going with Vanguard for three main reasons: 1) we already have a vanguard online account so less logins to manage 2) who doesn’t like saving $30/year? 3) some of the same funds in vanguard and utah, so no difference there.

Hope the above was helpful – and don’t forget to leave a comment!